The Board of Directors of APS Bank plc met on 7 March 2024 and approved the Group Annual Report and Audited Financial Statements for the financial year ended 31 December 2023.

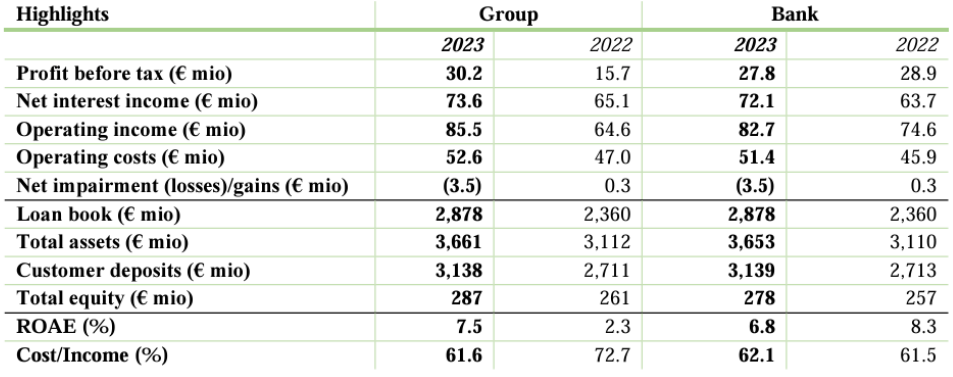

APS Bank plc is pleased to report a pre-tax profit of €30.2 million (2022: €15.7 million) for the Group and €27.8 million (2022: €28.9 million) for the Bank. Such a strong performance is underpinned by robust operating fundamentals and a growth strategy driven by ongoing digital transformation, enhancing the customer experience and maintaining asset quality. As market volatility subsided, the Group also started reversing some of the unrealised investments portfolio losses of 2022, boosting performance and equity.

Financial Performance

a) Interest income for the year under review amounted to €105.7 million, up by €25.8 million or 32.3% over 2022. The main contributor is the overall growth in the credit portfolio aided by improved pricing opportunities on business loans and advances and the syndicated loan book.

b) Interest payable more than doubled, from €14.8 million in 2022 to €32.1 million. The steep rise was due to higher repricing on domestic deposits and non-EUR funding as interest rates spiked, partly also including the effect of the Subordinated Bond issued in Q4.

c) Net fee and commission income went up by 21.0% to €8.3 million (2022: €6.9 million). This increase corresponds with the growth in business activity of the Group across several commission streams, like advances, card related transactions and investment services.

d) Other operating income generated was of €3.6 million, mainly from the net gains on financial instruments of €3.1 million for 2023, compared to the unrealised loss of €10.3 million posted in 2022.

e) Net impairment losses of €3.5 million for 2023 contrast with a writeback of €0.3 million posted for year 2022. In large part, the 2023 result is due to a credit charge taken on a syndicated loan which moved from stage 1 to stage 3 in the year under review, increasing the ECL charge.

f) Operating expenses in 2023 amounted to €52.6 million, up by €5.6 million on the previous year. Staff costs largely drove this increase as investment in human resources remains one of the priority drivers in the execution of the Group’s business strategy.

g) Staff expenses include a realised cost portion of share-awards granted in August 2023. Other increases were mainly arising from licensing and maintenance of technologies, regulatory and compliance requirements, professional and marketing fees, insurance, and other inflationary pressures.

h) Cost-to-income ratio from business operations for the year was 61.6%, an improvement of 11.1% over 2022 mainly as a result of a positive denominator effect thanks to the recovery in net operating income.

Financial Position

i) Total assets for the Group grew by 17.6% to €3.7 billion. Key contributors were:

- Net loans and advances to customers and the syndicated loan portfolio which in aggregate grew by 22.0% to €2.9 billion.

- Home financing remaining a key driver contributing to 56% of the overall increase in the loan book, followed by commercial and corporate lending.

- Cash and balances with the Central Bank of Malta increased by €45.2 million to reach €131.1 million, also earning higher interest in the process.

- Loans and advances to banks which contracted by €18.4 million to €54.5 million, counterbalancing the increase in balances with the Central Bank.

j) Group liabilities reached €3.4 billion, expanding by 18.3% or €0.5 million. Key contributors were:

- Customer deposits and amounts owed to banks which in a sharply competitive interest rate environment increased by €427.2 million and €30.3 million, respectively, to €3.1 billion and €80.7 million, respectively.

- The fund-raising strategy embarked on during 2H 2023 aimed at raising Minimum Required Eligible Liabilities (MREL), including Tier 2 instruments under the Subordinated Bond issuance programme.

k) Equity closed the year at €287.4 million, up by 9.9% or €26.0 million over last year’s closing of €261.5 million, mainly attributable to:

- The profit for the period of €20.6 million.

- Changes to the fair value on financial assets of €4.9 million, which also represent a partial recovery of the losses incurred in 2022.

- Scrip shares for 2022 (final) and 2023 (interim) dividend, with €6.0 million being retained in equity.

l) The Bank’s CET1 ratio stood at 14.6% (2022: 15.2%) and the Capital Adequacy Ratio at 20.6% (2022: 18.8%).

Dividends

The Directors are recommending a final gross dividend of €0.022 per ordinary share, totalling €8.5 million (final net dividend of €0.015 per ordinary share, or €5.5 million). The recommendation is to pay the dividend as Scrip, i.e. each shareholder having the option to receive the dividend in cash or through the issuance of new ordinary shares at an attribution price €0.55c per share. This dividend is subject to approval by the Malta Financial Services Authority and the shareholders at the Annual General Meeting and has not been included as a liability in the financial statements. Shareholders appearing on the register of members maintained by the Central Securities Depositary of the Malta Stock Exchange as at close of trading on 9 April 2024 (trading session of 5 April 2024) will receive notice of the Meeting and be entitled to the dividend.

During the financial year ended 31 December 2023, the Bank paid an interim gross dividend of €3.2 million (net dividend of €2.1 million). Taken together, the interim dividend and the declaration of this final dividend will amount to a total gross dividend payment for 2023 of €11.6m (total net dividend of €7.6m) or a total gross dividend per share of €0.031 (total net dividend per share of €0.020).

CEO Marcel Cassar commented:

“We are pleased to be reporting a record profit for APS Bank Group in market conditions that continue to present significant challenges. As banks across Europe announce a massive profit surge thanks mainly to the lift from rising interest rates, we note that such performances will be hard to repeat as the tailwind from interest rates subsides and central banks consider their next policy moves. Pertinent also that our strong operating results across the main business segments of retail, corporate banking and investment services reflect the robust growth enjoyed by the Bank in 2023, based on a business model centred around the provision of credit, savings and financial products to Maltese businesses and families. This also meant that, due to our higher pass-through of interest rate policy, our bonanza from higher interest rates has been relatively less than what other players in the market will experience.

Despite an international backdrop loaded with geopolitical risks and complex economic uncertainties, we look forward to the months ahead buoyed by a healthy business book, solid ratios for capital, liquidity, asset quality and excellent risk and operating indicators. At the same time, our rolling 3-year Business Plan, which now covers 2024-2026, identifies a number of strategic priorities foremost amongst which the stepping up of efforts to lower our funding costs and increasing our share of wallet as a primary bank of choice. As a purpose-led Bank and Group, we continue to believe in the Maltese market and the opportunities that it offers, with ongoing transformation and simplification of our channels, products and services while subscribing to a strong ESG ethic. Above all, we are confident that 2024 will present us with exciting prospects for further growth, and to create more value for our customers, communities and investors.”

The Annual Report and Audited Financial Statements for the year ended 31 December 2023 can be viewed on the Bank’s website: apsbank.com.mt/financial-information