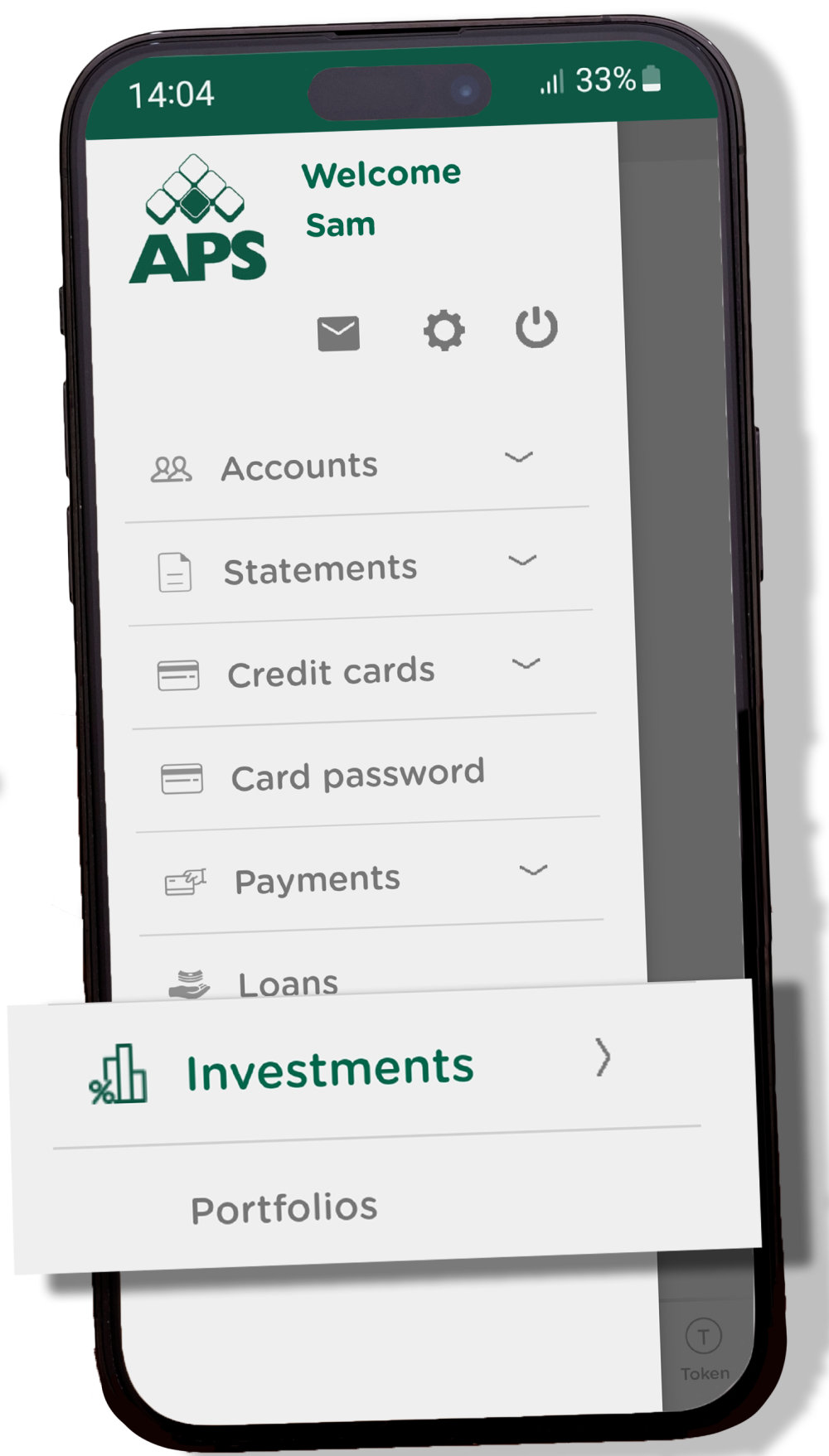

Monitor your investments using myAPS internet and mobile banking

✅ Instant access – monitor your investments 24/7.

✅ Detailed insights – view detailed information online, such as ISIN, asset class, price, and total market value.

✅ Download reports – download your investment reports in various formats.

Make more possible

Whether you are making your first investment or one as a mature investor, whether you are investing corporate money or planning for your company’s future, we have a highly experienced team to help you make the best decisions.

We are proud to offer Investment Advisors in our branches, and Relationship Managers for those who require a more focused engagement.

We are here to help you achieve all your investment goals by offering you free financial planning service. With our wide range of investment products and tools, you are guaranteed to find the optimal solution - no matter your lifestyle, age, individual needs and risk profile.

Why should you invest?

Let us start with the basic question: why should you invest? There are a number of reasons, which will depend on your personal situation.

Investing your money will ensure that it grows as much as possible. You can still have access – with certain conditions – to your money if you need it for a trip overseas, a family wedding or even an emergency.

You can start small and increase your investments when you can afford to.

Different investment products have different terms and conditions, so you can find the best fit, whether you are just starting to build up your portfolio or you are expanding an existing one.

Understanding your resources

Where do we come into it? It is important to understand not only what you have now, but how your resources and needs will change over time. We help you understand your current and future income and spending, your savings and assets, and other existing investments.

For businesses, we have experts who will identify your investment options in the context of your corporate objectives, including growth, profit and sustainability, and will help optimise returns on company liquidity.

Identify and prioritise your goals

Everyone has different financial goals and priorities – and these may change over time. To make sure you get the best advice, our Investment Advisor or Relationship Manager will discuss your needs, wants and financial situation – all on a complimentary basis.

They can then provide you with a tailor-made plan on how best to achieve your financial goals, taking into account aspects such as financial planning, risk management, portfolio diversification and estate planning. This depends on how much you wish to invest, what your risk appetite is, whether you may want or need to access part or all of your investment in the short term, and whether you are planning for the future.

You may want to maximise the return on your investment, or find a more conservative, risk-averse option. We can guide you accordingly.

Find products which meet your needs

There is a wide range of products, and our job is to find the one that is most closely aligned with your requirements. You may opt for investments, such as:

- Local and foreign bonds and shares

- ETFs

- Mutual funds

- Foreign currencies

- Insurance policies

- Pension plans

If you are looking to invest – whether you are a retail client or a professional one – we offer you three different investment services:

- Execution-only: we only carry out your investment decisions

- Advisory: we advise you on your investment strategy but you will make the final decisions

- Discretionary: we define together your objectives and your risk appetite and we will then take charge of all investment decisions

Whether you are seeking income generation, capital appreciation, or optimising returns from liquidity, we can help you to find the optimum financial solution. This all depends on what you require and your risk tolerance, and since this is something that may change with time, we also look at things from a longer-term view. This means thinking ahead too, and we can also offer retirement and life insurance planning advice.

Review your plan regularly

This step is essential. As your life and the world around you change, your financial plan will need to be adjusted and adapted in line with the economic environment and personal changing circumstances.

Our Investment Advisors and Relationship Managers will be able to guide you should any changes be required to maximise your new circumstances.

Fill in the form to set an introductory meeting and discuss your investment goals.

Investor digest

Discover the latest insights on local and foreign investment markets with our Investor digest, including expert commentary on market trends and developments.

Book an appointment

Latest articles

Central Bank Independence: A Hard-Won Achievement Under New Pressures

26 January, 2026The independence of central banks stands as one of the most consequential institutional innovations in modern economic governance.

Read moreRare Earths: The Hidden War for the Building Blocks of the Future

18 December, 2025Rare earth elements are now a frontline in the broader geopolitical contest between the United States and China.

Is Secured Credit Safer? Rethinking Asset Quality in Credit Markets

30 October, 2025Most investors tend to treat secured credit as the safer corner of the fixed-income universe. The logic appears straightforward: when a borrower pledges collate...

Read moreApproved and issued by APS Bank plc, APS Centre, Tower Street, B’Kara BKR 4012. APS Bank plc is regulated by the Malta Financial Services Authority as a Credit Institution under the Banking Act 1994 and to carry out Investment Services activities under the Investment Services Act 1994. Terms and conditions apply and are available on request.