Take control of your future with the APS Personal Pension Plan, the long-term plan you need to enjoy a hassle-free and comfortable retirement.

When taking out an APS Personal Pension Plan, you will:

- Make regular contributions to your personal pension plan

- Have a range of investment strategies to choose from

- Choose between receiving your pension either as a tax-free lump sum plus an income or all as an income

- Have online access to your pension plan portal

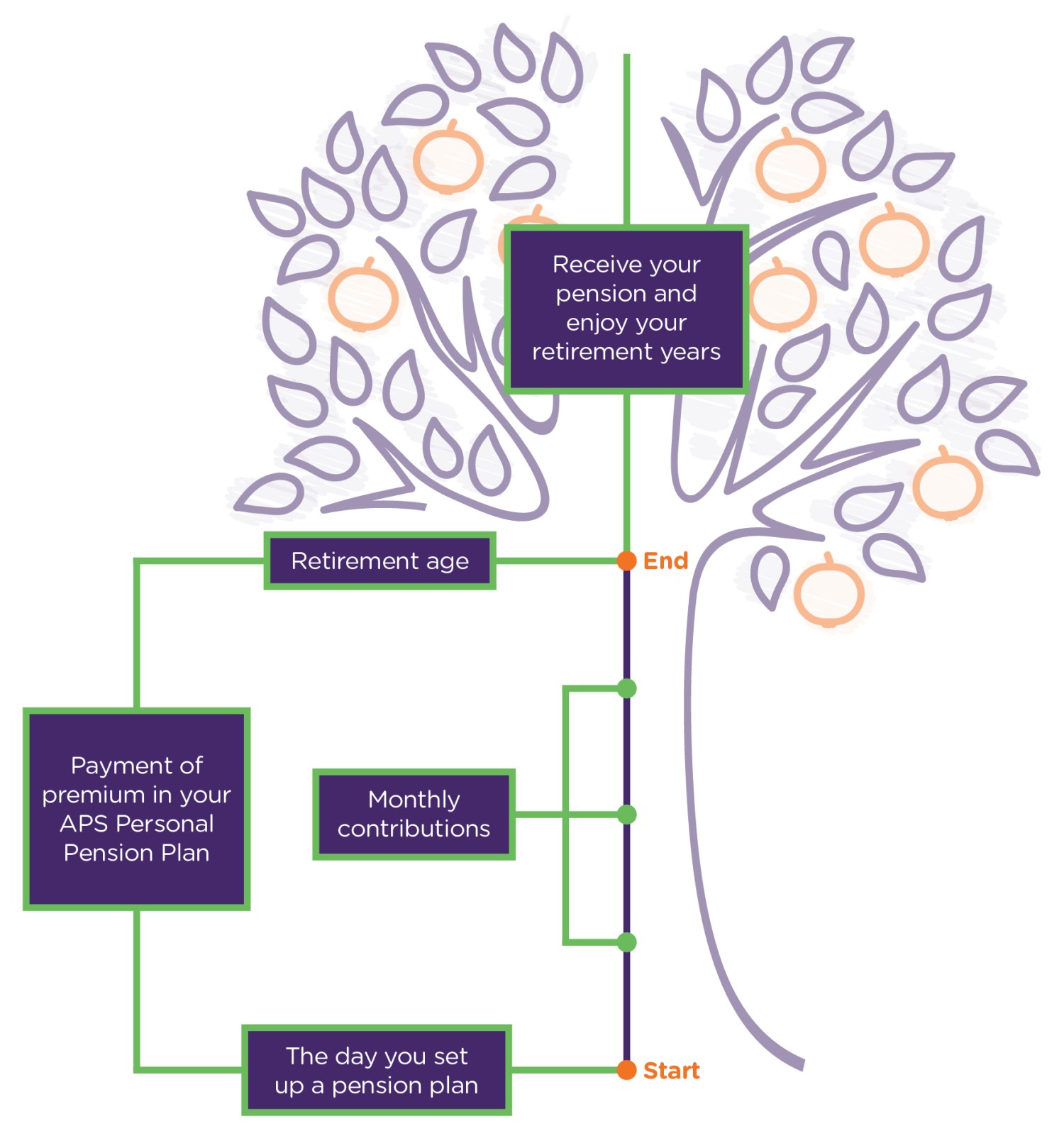

Your APS Pension Plan Journey

Top up your Pension

We all live with the expectation that a time will come when all our hard work will have paid off and we’ll get to enjoy retirement.

However, the cost of living is on a steady increase. In addition, today’s value of the Euro (€) will have undoubtedly decreased by the time you reach retirement.

By supplementing your State pension with your own plan, you’re taking control of your future and the life you want to lead after you retire.

What are the tax benefits?

Through the APS Personal Pension Plan, you stand to benefit from a tax rebate of 25% of your annual contributions (up to €750 per year). Therefore, if you pay €3,000 into your plan, you’ll receive €750 back as tax rebate.

Why choose APS Bank?

We, at APS Bank, understand the need and importance to plan ahead to avoid any financial burdens in the future. Your retirement is a time to relax and spend time doing what you love, not worry about financial implications.

At APS Bank, we’re committed to providing expert advice regarding your finances from the get-go. We transform any financial worries that you may have into financial security, ensuring that you’re free to focus on your future plans and goals.

Book an appointment

Approved and issued by APS Bank plc as the distributor of the Scheme and the protector of the Trust. APS Bank plc is regulated by the Malta Financial Services Authority as a Credit Institution under the Banking Act 1994 and to carry out Investment Services activities under the Investment Services Act 1994. The APS Personal Pension Plan is licensed and regulated as a personal retirement scheme by the Malta Financial Services Authority in terms of the Retirement Pensions Act (Chapter 514 of the Laws of Malta). Praxis PES Malta Limited is authorised by the Malta Financial Services Authority to act as a Retirement Scheme Administrator to Retirement Schemes registered under the Retirement Pensions Act, 2011. Terms and conditions apply and are available on apsbank.com.mt/personal-pension. There is no statutory provision for compensation in the case where a retirement scheme is unable to satisfy the liabilities attributable to it and the license of the Scheme is not an endorsement by the MFSA of the Scheme’s financial performance. All prospective Contributors and/or Members should consult their own professional advisors as to the legal, tax, financial or other matters relevant to the suitability of a contribution to the Scheme.