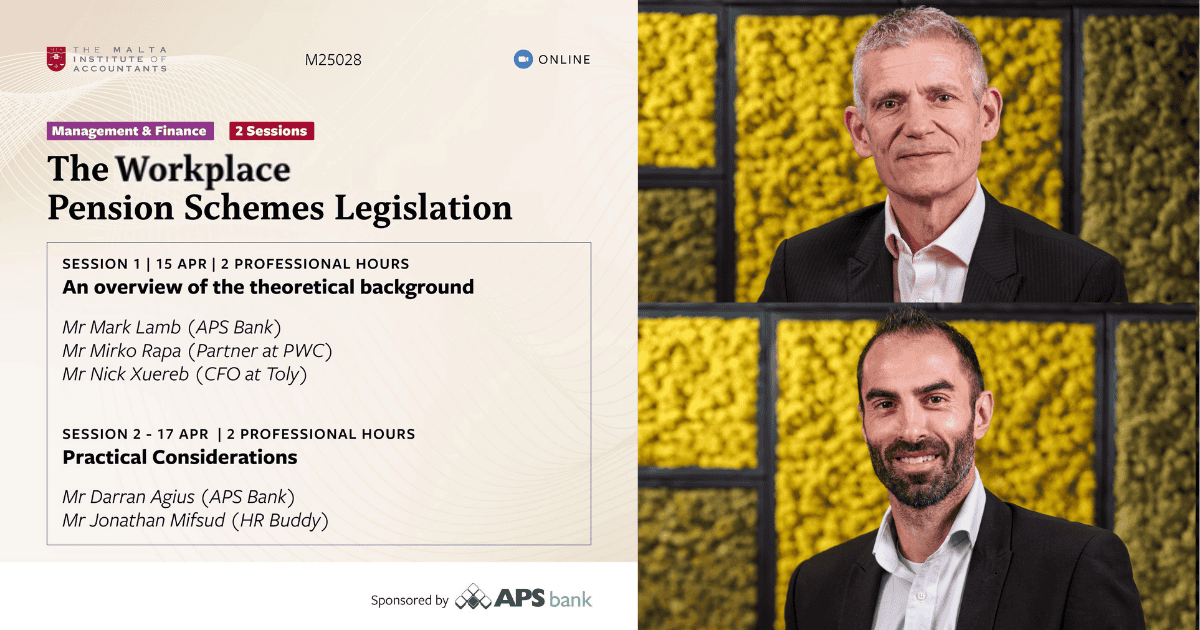

APS Bank took part in two online Counting Professional Education (CPE) sessions organised by the Malta Institute of Accountants (MIA) on 15 and 17 April 2025. The sessions, led by Mark Lamb, Corporate Schemes Manager, and Darran Agius, Corporate Schemes Relationship Manager, focused on the upcoming Workplace Pension Schemes legislation and its impact on the accounting profession.

Titled “The Upcoming Workplace Pension Schemes Legislation: How the Mandatory Setup of Workplace Pensions Will Shape the Accounting Profession from a Tax Management and Payroll Perspective”, the sessions explored how this new legislation will influence payroll processes and tax compliance. The sessions also outlined how accountants can support their clients in adapting to these expected changes.

Over 140 MIA members attended the sessions, which generated strong engagement and positive feedback. Participants were given practical insights to help them prepare for the mandatory rollout of workplace pensions via payroll, as announced in the recent Budget.

Mark Lamb, Corporate Schemes Manager at APS Bank, commented:

“We welcomed the opportunity to speak with MIA members about this important development. The anticipated new workplace pension requirements will have a direct impact on tax and payroll systems, so it’s essential that accounting professionals are well-informed. These sessions were a step in supporting that readiness.”