“Someone is sitting in the shade today because someone planted a tree a long time ago.” This powerful metaphor, often attributed to Warren Buffet, highlights the importance of investing early, patience and the power of compounding interest over the long term.

Benjamin Franklin explained compound interest as “Money makes money. And the money that money makes, makes money”. Simply put, it is when you earn interest on the capital invested, but also on the interest you have already received. This can have an often-overlooked impact on long term savings. Over time, compound interest allows investments to grow exponentially and can help turn small amounts into large cash piles over many years, through discipline and patience.

Why Should You Be Interested in Compounding?

In practice, an appreciation for compound interest can have implications on decisions such as when to start saving, the benefits of a private pension, whether to invest in a Fund accumulator share class or distributor share class and even whether to borrow, and for what purpose.

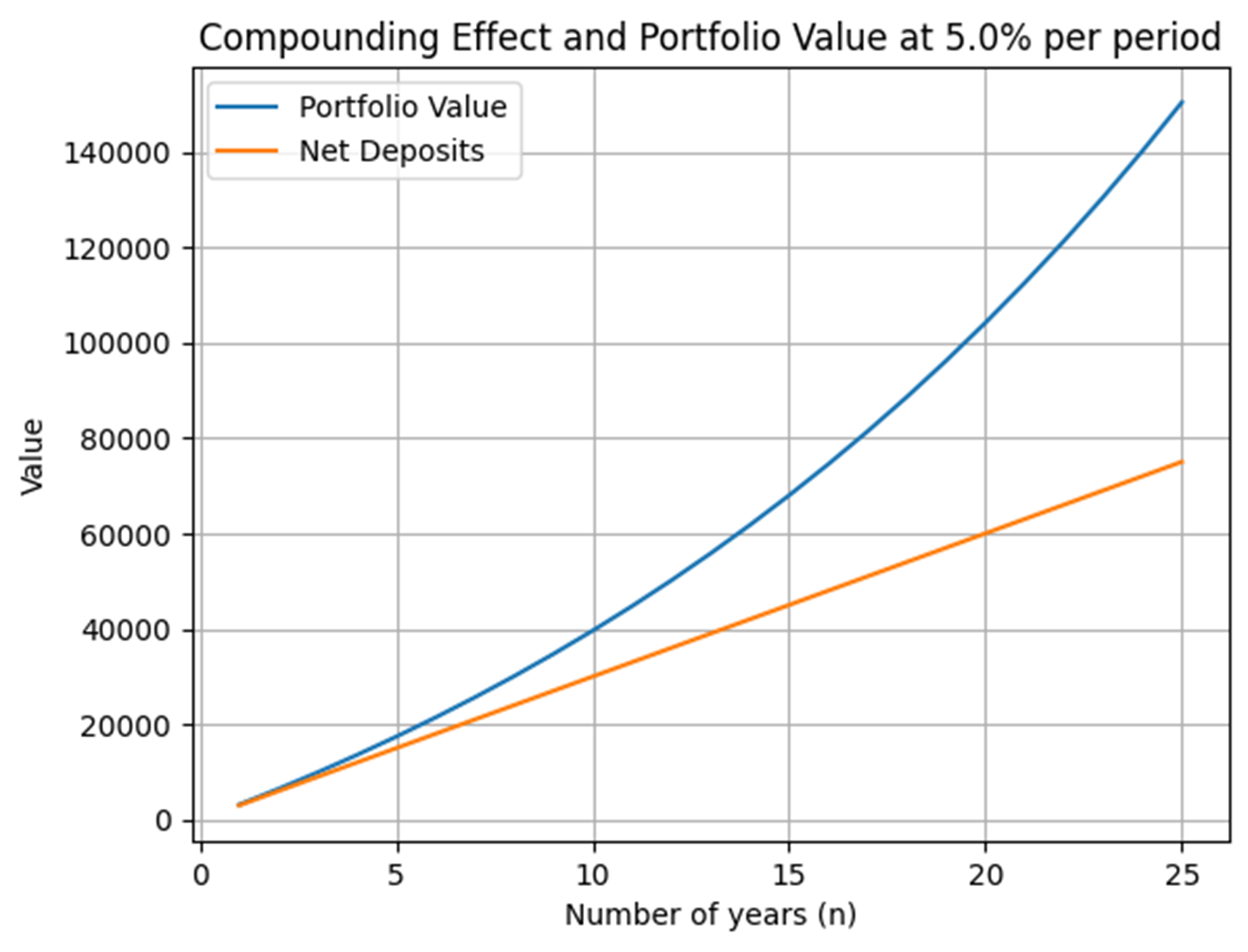

By way of example, if a family invests €3,000 a year for their newborn daughter into a diversified equity portfolio, they would have invested around €75,000 by the time she turns 25. Assuming this portfolio achieves an annualized return of 5% each year, she would have accumulated a further €75,000 from accrued investment returns. By age 25 she would have accumulated ~€150,000.

The Most Economic Decision – Starting Early

To illustrate this in a different way, consider two individuals, Louisa and John:

- Louisa starts investing €5,000 per year at age 25 for 10 years and then stops contributing and allows her investment to continue to accrue interest until she is 65 years old. She would have contributed €50,000 over these 10 years.

- John starts investing at 35 and also contributes €5,000 per year. John contributes this for 30 years or until he is 65, investing a total of €150,000.

Both Louisa and John make 8% per annum on their investments. At age 65, Louisa’s wealth has grown to ~€730,000 whereas John’s has grown to ~€610,000, despite making three times the contributions. This was possible because of the additional time that Louisa was invested and the power of compounding. This highlights the importance of starting your investment journey early – whether via a savings plan, tax efficient private pensions or otherwise.

The Dual Nature of Compounding: Risk and Reward

Compounding interest can work both ways, just as it magnifies gains over the long term, it can also magnify losses. This is why it is important to diversify investments to manage risk and to strike a balance between capital growth and capital preservation.

While compounding can significantly grow your investments, it’s important to consider the impact of inflation. Over long periods, inflation can erode the purchasing power of your money. Therefore, aiming for a return that outpaces inflation is crucial to truly benefit from compounding.

Investing early and consistently requires patience, discipline, and a long-term mind-set. It is important to stay committed to an investment plan, especially during market downturns. Emotional resistance and avoiding impulsive decisions can significantly enhance the benefits of compounding.

In conclusion, the power of compounding is one of the most valuable tools available to investors. By starting early, investing consistently, and allowing your investments to grow over time, you can build significant wealth. Whether you’re saving for retirement, a home, or a future goal, compounding will play a pivotal role in helping you reach your financial aspirations.

Remember, time is your greatest ally when it comes to compounding. The sooner you start, the more you can benefit from this extraordinary force. As the Chinese proverb goes, “The best time to plant a tree was 20 years ago. The second-best time is now.“

Written by

Michael Tabone, CFA

Senior Portfolio Manager, ReAPS Asset Management Ltd

The information contained in this article represents the opinion of the contributor and is solely provided for information purposes. It is not to be interpreted as investment advice, or to be used or considered as an offer, or a solicitation to sell / buy or subscribe for any financial instruments nor to constitute any advice or recommendation with respect to such financial instruments. This article was issued by ReAPS Asset Management Limited, a subsidiary of APS Bank plc. ReAPS Asset Management Limited (C77747) with registered address at APS Centre, Tower Street, Birkirkara BKR 4012 is regulated by the Malta Financial Services Authority as a UCITS Management Company and to carry out Investment Services activities under the Investment Services Act 1994 and is registered as an Investment Manager under the Retirement Pensions Act.