Most investors tend to treat secured credit as the safer corner of the fixed-income universe. The logic appears straightforward: when a borrower pledges collateral – whether real estate, equipment, or receivables – lenders gain a tangible claim that can help cushion potential losses in the event of default. Unsecured credit, by contrast, depends solely on the borrower’s capacity and willingness to repay, which all else equal, carries greater risk.

However, market experience shows that relying on collateral alone oversimplifies reality. Collateral can mitigate losses, but it can also disguise deeper structural vulnerabilities or weaker borrower quality.

In today’s complex credit landscape, where financial innovation blurs the traditional boundaries between “secured” and “unsecured”, investors must look beyond the presence of collateral to understand true asset quality. A disciplined assessment of borrower strength, capital structure, and recovery potential remains critical to navigating risk effectively in modern credit markets.

Secured Debt: Beyond the Collateral

Secured debt grants a legal claim (lien) on specific corporate assets (the collateral), but the protection it offers depends on the quality and liquidity of those assets. Investors in secured bonds must remain aware that senior secured bank loans often have stronger control over collateral and covenants and typically receive a higher lien on a company’s most reliable assets. These may include cash-generating assets like real estate, and plant and equipment.

The Caveat: The lien on the bond only entitles creditors to the net sale proceeds of the collateralized assets. If a distressed sale yields less than anticipated, the recovery for the investor will be commensurately low, converting the remaining debt into a general unsecured claim. This is especially common when the collateral consists of illiquid or speculative assets, such as undeveloped land.

Unsecured Debt: Faith in the Issuer

On the other hand, unsecured debt relies entirely on the borrower’s general ability to service its obligations, making it a pure credit bet. The reality is that in cases of liquidation, unsecured creditors divide the proceeds from the liquidation of the company’s unencumbered assets. Their recovery rate is typically a small fraction of the face value, and often, it is zero.

The nuance arises in what many analysts call the Collateral Quality Paradox: the safest borrowers often issue unsecured debt, while weaker ones must offer collateral to obtain financing. In other words, security could sometimes be a signal of risk, not a mitigator of it.

For investment-grade unsecured credit, the average probability of default (PD) is less than 1% and the typical loss given default (LGD) is 40-50%. Multiplying these gives an expected loss of around 0.5%, indicating very low credit risk, supported by robust cashflows. In contrast, leveraged loans (secured) have a PD of 5-7% and a LGD of 20-30%, resulting in an expected loss of 1-2.1%. Even though these loans are collateralized, their higher default probability makes them riskier than investment-grade unsecured bonds.

This paradox becomes most prominent during downturns. When asset prices fall, collateral values erode just as defaults rise – a phenomenon known as wrong-way risk. The 2008 subprime crisis demonstrated this dramatically: mortgage-backed securities were “secured”, yet their collateral collapsed in tandem with borrower solvency.

Modern Market Dynamics

In the post-2020 cycle, global credit markets have evolved in ways that further complicate the secured-unsecured distinction:

- Leveraged loans and CLOs, though secured, face weaker covenants and limited secondary market liquidity;

- Global corporate bond markets are dominated by investment-grade unsecured issuers, often exhibiting greater transparency, liquidity, and investor protection via rating surveillance; and

- Real-estate-backed credit; particularly in Europe and China, has proven vulnerable to valuation shocks and enforcement delays.

Emerging or less developed markets may face a troubling scenario in which a company can borrow more cheaply from the public (via a bond issue) than from better-informed banks. When banks are unwilling to lend, or demand significantly higher spreads compared to a public issuance, this may signal:

- Concerns about credit quality or collateral, especially if the firm is highly leveraged or in a highly speculative industry, and

- Bond market mispricing or exuberance, where public investors underestimate the true risk – a situation that can reverse abruptly in tighter financial conditions.

Data and Performance: What the Numbers Show

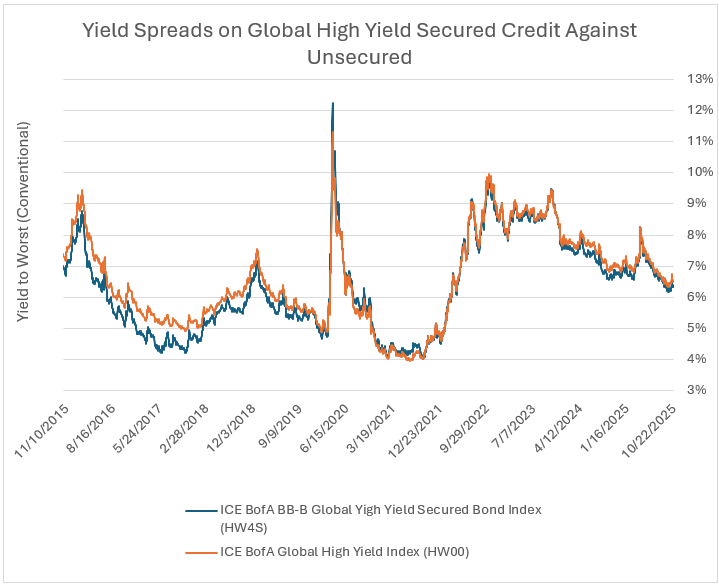

Over the past decade, the average yield spread between secured and unsecured high-yield credit has narrowed sharply. This data suggests that while collateral still lowers losses, it does not guarantee lower total risk. Liquidity, borrower quality and structural protections increasingly dominate credit outcomes.

Secured and Unsecured Credit: Lessons for Investors

The assumption that “secured credit equals safe” does not hold up. Credit investors should instead focus on:

- Diversification between issuers, sectors and geographies,

- Cashflow durability,

- Collateral quality and liquidity,

- Covenant strength – especially in private credit and highly leveraged loan markets, and

- Structural subordination – understanding how collateral is shared among creditors.

As markets evolve, unsecured high-grade issuers may offer better long-term protection than nominally secured high-yield borrowers. In modern credit investing, security of repayment matters more than secured collateral.

For investors who find navigating the bond market complex or have limited capital to achieve proper diversification, professional investment managers offer valuable expertise. Leveraging their deep understanding of financial markets and access to credit research providers, they can construct and manage bond portfolios that aim to optimise returns while controlling downside risks, providing investors with efficient and informed access to fixed-income opportunities.

Written by

Gabriel Nappa

Research Analyst, ReAPS Asset Management Ltd

The information contained in this article represents the opinion of the contributor and is solely provided for information purposes. It is not to be interpreted as investment advice, or to be used or considered as an offer, or a solicitation to sell/buy or subscribe for any financial instruments nor to constitute any advice or recommendation with respect to such financial instruments. This article was issued by ReAPS Asset Management Limited, a subsidiary of APS Bank plc. ReAPS Asset Management Limited (C77747) with registered address at APS Centre, Tower Street, Birkirkara BKR 4012 is regulated by the Malta Financial Services Authority as a UCITS Management Company and to carry out Investment Services activities under the Investment Services Act 1994 and is registered as an Investment Manager under the Retirement Pensions Act.