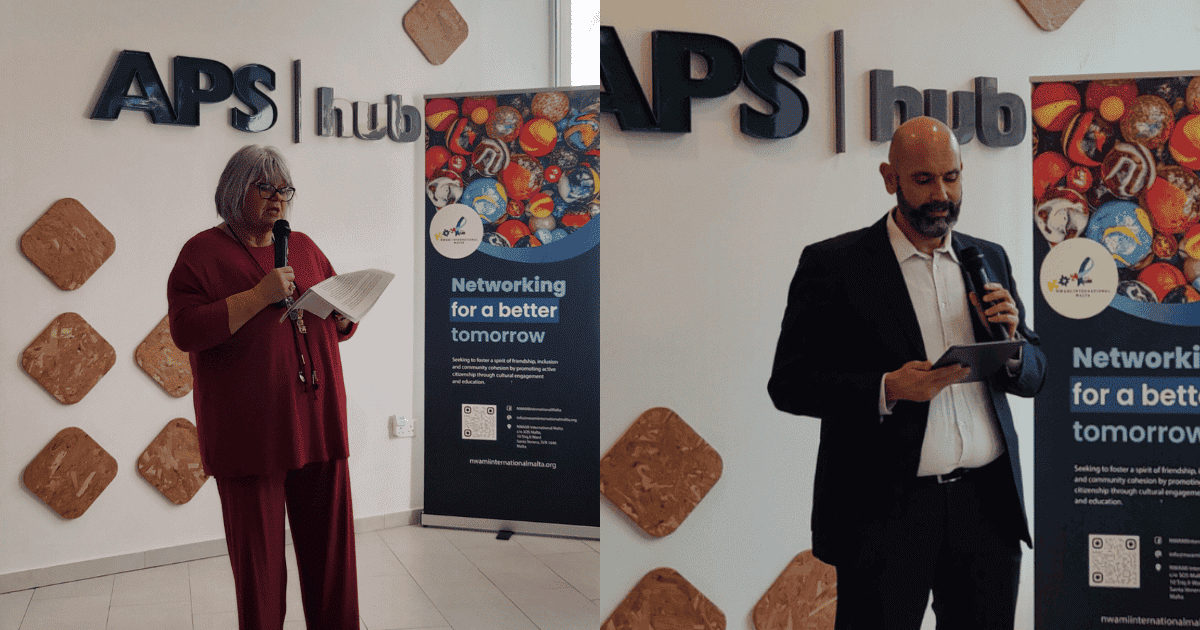

APS Bank yesterday held its first Market Briefing of the year, with a high level look at how 2025 has closed and sharing its outlook for 2026 amid an evolving economic, regulatory and risk environment. Senior management members contributed to the event where it was revealed that a final dividend is being recommended with a proposal already sent to MFSA.

In his introduction, CEO Marcel Cassar spoke about the contrasting forces shaping banking, from technological disruption and regulatory demands to geopolitical uncertainty and margin pressures. While lower interest rates are expected to benefit asset quality, narrower margins mean that profitability must come from “more efficiency, diversification and innovation – and this is also what shareholders and investors expect”, adding that “as a bank that innovates responsibly, manages risks proactively, and is courageous about its growth ambitions, APS Bank is positioned to thrive.”

Josef Portelli, Head of Investment Management and Managing Director of the Bank’s subsidiary ReAPS Asset Management, shared insights on global market developments, noting that despite heightened geopolitical noise, the global economy is expected to remain resilient. Chief Risk Officer Giovanni Bartolotta discussed key trends shaping the banking outlook, including strong local economic fundamentals, improving asset quality and a competitive landscape marked by technological change.

Chief Strategy Officer Liana Debattista outlined the Bank’s strategic priorities for 2026, emphasising disciplined execution and a continued commitment to its community banking model. Chief Financial Officer Ronald Mizzi reported that 2025 is closing with all-round superior KPIs than forecast, while providing a glimpse of what are the high level expectations for 2026 sustained by the Bank’s strengthened capital base following the recent Rights Issue.

The presentation and a recording of the Market Briefing are available for viewing on the Bank’s website.