From pharaohs who saw it as divine, to explorers who crossed oceans for it, to fortune hunters chasing dreams of wealth across frontiers – gold has always had a grip on the human imagination. The pharaohs considered it the flesh of gods symbolising eternal life and divine power. Under the Greek and Roman empires, gold became a symbol of wealth, empire and military might. In more recent its history has sparked obsessions and ruthless conquests. Much of its allure persists till this day with Governments and Central Banks holding the precious metal as a safeguard of national wealth. At the same time people buy jewellery and invest in bullion as symbols of security and status.

Gold and the Birth of Money

Gold has always played an important role in the international monetary system. Precious metals acted as a universal medium of exchange and standard of value, allowing for specialisation of labour, expansion of trade networks, and the accumulation of capital. Once the concept of money spread, markets became more complex and structured – from local fairs to long-distance trade routes. The use of currency allowed for price discovery, accounting, contracts, and credit, creating the foundation of what is today the modern market.

Regulation and Ownership

Prized for its rarity and durability, gold became a universal reference point for cross-border trade and wealth accumulation. The earliest recorded use in coinage dates as early as the 6th Century BCE in Lydia, modern day Turkey. Eventually, its private ownership was subject to scrutiny, with governments increasingly regulating individual holdings. In many jurisdictions, private users were required to deposit their gold with banks or state institutions, receiving instead certificates of deposit or other paper claims that represented, but replaced, direct access to physical gold. Until 1975, private ownership of significant amounts of gold was illegal in the US, and in the UK one was restricted from owning more than four gold coins and needed a license to hold gold bullion.

The Gold Standard and Bretton Woods

By the end of the 19th century, gold’s monetary role peaked with the classical gold standard (1870s-1914) where currencies were directly convertible into gold, anchoring exchange rates and fostering global financial integration. After WW1, variations like the gold-exchange standard and eventually the Bretton Woods system (1944-1971) tied global finance to gold until the US suspended convertibility in 1971. Post 1971, although no longer backing currencies, it remains a key reserve asset with central banks holding gold as a hedge against inflation, currency debasement, and systemic crises. Investors treat it as a “safe haven” during financial turbulence.

Today’s Gold Market

Today, the gold market remains relatively small however sustained by strong demand from global central banks. The Central Bank of China, for example, has increased their gold stock significantly from around 1,700 tonnes in 2015 to over 2,300 tonnes in 2025.

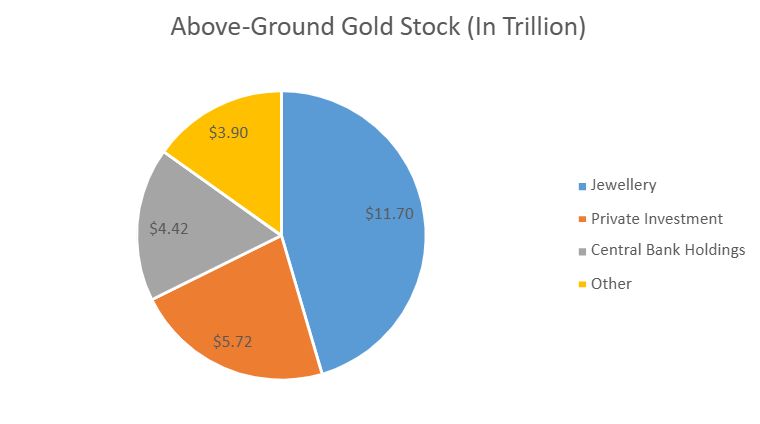

The total global value of above-ground gold stock is estimated at ~$25.9 trillion at current prices, of which nearly half is in the form of jewellery. ~$3.9 trillion is tied up for industrial use and ~$4.4 trillion is held in central banks vaults. The tradable float of gold stock stands at only ~$5.7 trillion. In comparison, total non-gold FX reserves are nearly ~$14.6 trillion

To put into perspective, if we had to put all the gold ever mined in the same place, it would be the size of a cube measuring 22 metres by 22 metres and is worth around 50% of the value of the S&P 500 and multiple times the value of all the farmland in the United States.

Gold at Record Highs

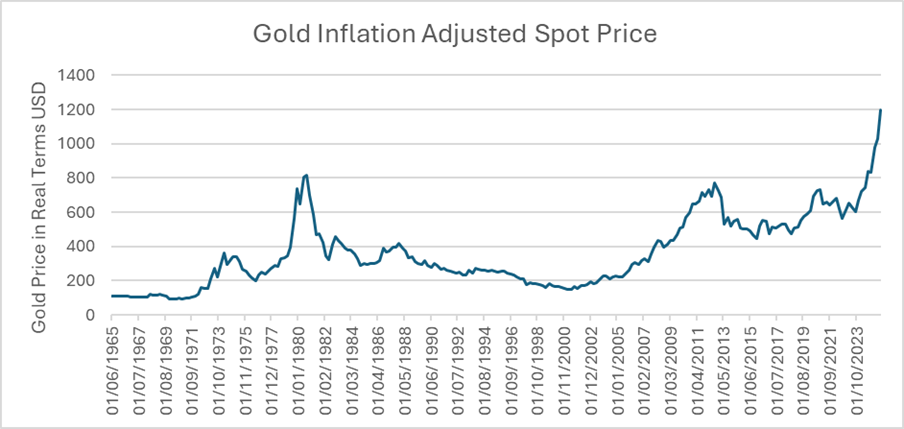

The price of a troy ounce of gold is currently above $3,800, which represents an all-time record high after rallying over 45% year to date. Traditionally, this would be a classic sign of fear, not rampant optimism, as is being experienced in markets currently. In real terms (adjusted for inflation), its prices are also at record highs, which contrasts with the dot com bubble, where gold prices were at multi decade lows, whilst the stock market peaked. The current gold rally is driven by geopolitical concerns, US trade policy, moves by the US administration undermining the independence of the FED and speculative ETF demand.

The Drawbacks of Gold as an Investment

As an investment, gold has its drawbacks. Compared to traditional financial securities, it does not generate any cashflows, can be volatile and if held in physical form involves insurance and storage costs. Gold also has no utility apart from limited industrial use. Warren Buffet described this eloquently:

“Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Conclusion: Gold’s Timeless Appeal

Nevertheless, precious metals such as gold, have their place in a well-diversified portfolio and are especially useful in times of crisis when the market is fearful. Whether you see it as a superstition of the past or a safeguard for the future, gold’s story is far from over. As long as uncertainty persists – in markets, politics, and geopolitics – the ancient metal will continue to glitter in the modern imagination, reminding us that value is never just about numbers on a screen, but also about trust, belief, and is influenced by history itself.

Written by

Michael Tabone, CFA

Senior Portfolio Manager, ReAPS Asset Management Ltd

The information contained in this article represents the opinion of the contributor and is solely provided for information purposes. It is not to be interpreted as investment advice, or to be used or considered as an offer, or a solicitation to sell / buy or subscribe for any financial instruments and/ or investment services nor to constitute any advice or recommendation with respect to such financial instruments and/ or investment services. This article was issued by ReAPS Asset Management Limited, a subsidiary of APS Bank plc. ReAPS Asset Management Limited (C77747) with registered address at APS Centre, Tower Street, Birkirkara BKR 4012 is regulated by the Malta Financial Services Authority as a UCITS Management Company and to carry out Investment Services activities under the Investment Services Act 1994 and is registered as an Investment Manager under the Retirement Pensions Act.